will child tax credit payments continue into 2022

Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec. 31 2022 in his Build Back Better plan.

Stimulus Check Update These Families Will Get 3 600 In 2022 Wbff

If signed into law the White House says the bill would mean the 250 and 300 monthly payments would go out monthly in 2022.

. Will there be a child tax credit in February 2022. A payment of tax credits for the tax year 2022 to 2023. Nov 8 2022 601 AM.

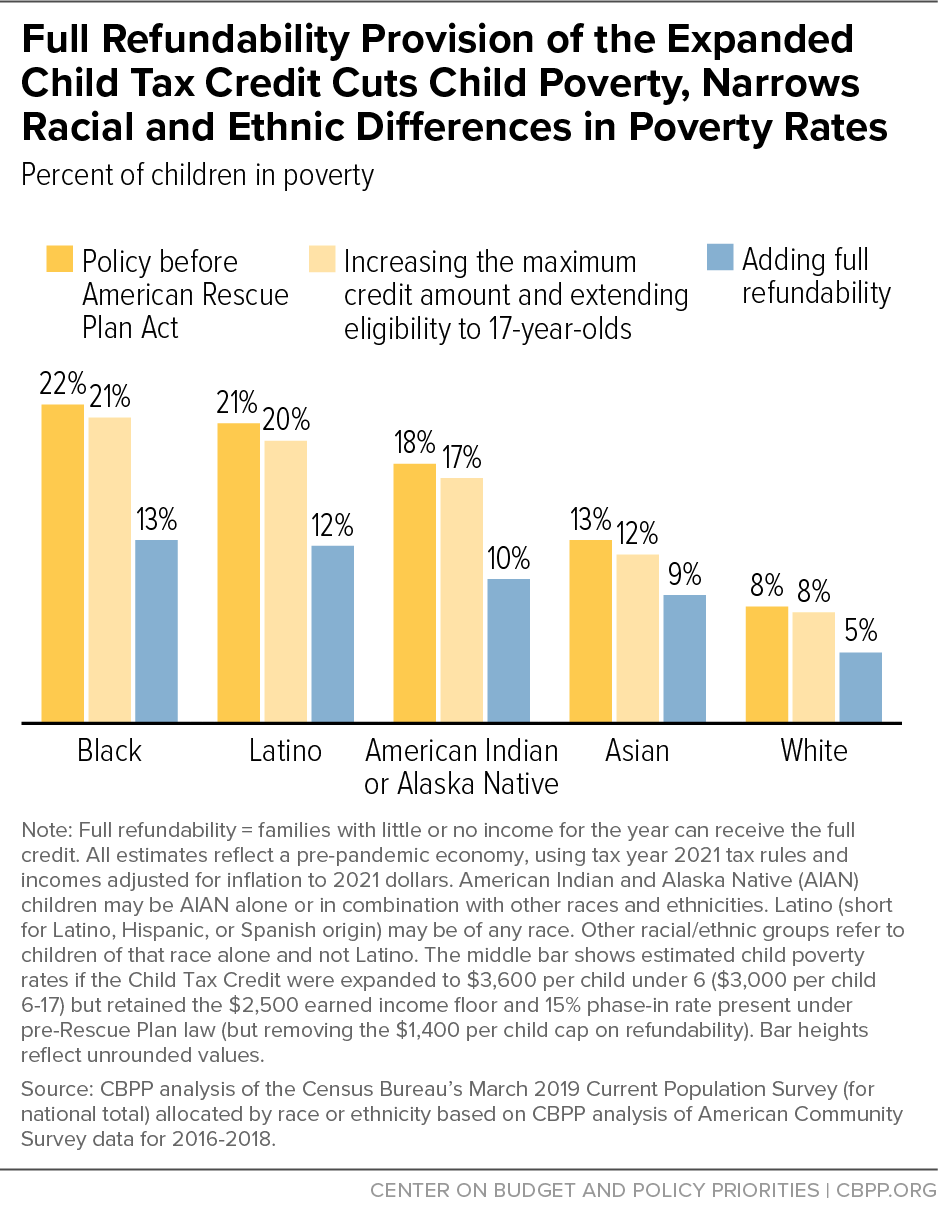

Families could qualify for up to 3000 per child between ages 6 and 17 and 3600 per child under 6 and receive half of the sum before actually filing their taxes. The way it looks right now the increased child tax credits wont be continuing into 2022. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Soon after taking office President Joe Biden signed into law the 19 trillion American Rescue Planthe third and final stimulus package aimed at combating the COVID-19. Within those returns are families who qualified for child tax credits ctc.

In addition the IRS Free File program remains open until Nov. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your. Theres a plan to extend the credit but politics is getting in the way.

Government disbursed more than 15 billion of monthly child tax credit payments in July. In total itd cover 35 million householdsor. Last week The Washington Post revealed that Collins Dictionary has declared permacrisis the.

Will i get the child tax credit if i have a baby in december. So parents could only receive half their total child tax credit money 1800 or 1500 via those payments -- 300 per child per month under age 6 and 250 per child per. Child Tax Credit Payment Schedule 2022 from pincaliforniacompanyinfo The payments will be paid via direct deposit.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. 1 day agoUnder last years American Rescue Plan the maximum Child Tax Credit increased to 3000 or 250 a month for each child aged 6 to 17. Any future extensions to the expanded child tax credit may not be in the cards if Republicans manage to.

Here is what you need to know about the future of the child tax credit in 2022. Families who are eligible for the expanded credit may see more money come to them when they file their taxes this year as just half of the total. 17 for those who still need to file.

Child Tax Credit Payment Schedule 2022. The child tax credit reverts to its 2000 per child limit for individuals filing in 2023. Another key deadline is coming up next week for parents eligible for the November child tax credit payment the second-to-last one of the yearThe credit is.

And to 3600 or 300 a month for. Child tax credit payment schedule 2022 chigasakiribbon. 2 days agoNo corporate tax cuts without expanding the child tax credit.

2 days agoFuture of Direct Payments to Americans At Risk in 2022 Midterms. This credit begins to phase down to 2000 per child once household income reaches 75000 for individuals 112500 for heads of household and 150000 for married.

Child Tax Credit Improvements Must Come Before Corporate Tax Breaks Center For American Progress

The American Families Plan Too Many Tax Credits For Children

Explaining The New 2022 Child Tax Credit And How To Claim Familyeducation

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979633/GettyImages_1369365621.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Feds Launch Website To Claim 2nd Half Of Child Tax Credit Ktla

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Child Tax Credit Will Monthly Payments Continue In 2022 11alive Com

The Child Tax Credit Research Analysis Learn More About The Ctc

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

Child Tax Credit Will Monthly Payments Continue Into 2022

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet